Investing in the technology sector can be a lucrative endeavor, but it requires careful consideration and strategic planning. In this article, we’ll explore the essentials of investing in the best tech stocks, focusing on investment outlook, risk assessment, market trends, and more. Whether you’re a seasoned investor or just starting, these insights will help you make informed decisions.

Understanding the Investment Outlook

The technology sector has been a consistent performer in the stock market, with many tech companies showing robust financial performance and growth potential. The investment outlook for tech stocks remains positive due to the continuous innovation and adoption of new technologies across various industries.

Market Trends and Industry Analysis

Analyzing market trends and the overall industry landscape is crucial for identifying the best tech stocks to invest in. Emerging technologies like artificial intelligence, blockchain, and 5G are driving significant changes and creating new opportunities. Keeping an eye on these trends can provide valuable insights into potential investment opportunities.

Moreover, understanding the competitive landscape within the tech sector is essential. Companies that lead in innovation and market share are often the best investment opportunities. Regularly reviewing industry reports, attending tech conferences, and following thought leaders can help you stay ahead of the curve.

Geopolitical Factors

Geopolitical factors can impact the performance of tech stocks. Trade policies, regulatory changes, and international relations can influence market dynamics. Investors should stay informed about these factors and consider their potential impact on the tech sector.

It’s also important to consider how geopolitical tensions can affect supply chains. For example, trade wars can disrupt the availability of crucial components for tech companies, impacting their operations and profitability. Staying updated with global news and understanding geopolitical risks can help you make informed investment decisions.

Technological Advancements

Technological advancements drive growth in the tech sector. Keeping up with the latest innovations such as quantum computing, augmented reality, and advancements in cybersecurity can help you identify companies poised for future success.

Investing in companies that are at the forefront of technological advancements can offer significant returns. These companies often enjoy first-mover advantages and can set industry standards. Researching patents, new product launches, and R&D investments can provide insights into a company’s commitment to innovation.

Risk Assessment

Investing in tech stocks involves risks, and it’s essential to assess these risks carefully.

Financial Performance and Stability

Evaluating the financial performance and stability of a tech company is a fundamental step in risk assessment. Key metrics to consider include revenue growth, profit margins, debt levels, and cash flow. Companies with strong financial health are better positioned to weather market volatility.

It’s also important to review a company’s historical financial performance. Consistent revenue growth over multiple quarters or years is a positive indicator of stability. Additionally, understanding a company’s business model and revenue streams can help assess its financial resilience.

Diversification

Diversification is a risk management strategy that involves spreading investments across different assets or sectors. By diversifying your portfolio, you can reduce the impact of any single investment’s poor performance. In the context of tech stocks, consider investing in companies across various tech sub-sectors, such as software, hardware, and semiconductors.

Diversification can also include investing in tech companies of varying sizes, from established giants to promising startups. This approach can balance risk and reward, as larger companies provide stability while smaller ones offer growth potential. Regularly reassessing your portfolio and adjusting your diversification strategy is key to managing risk effectively.

Long-Term vs. Short-Term Investing

Decide whether you are looking for long-term growth or short-term gains. Long-term investing involves holding stocks for several years, allowing you to benefit from the company’s growth over time. Short-term investing, on the other hand, focuses on capitalizing on market fluctuations and requires a more active trading approach.

Long-term investing can provide stability and compound growth, making it ideal for retirement planning. In contrast, short-term trading can be lucrative but comes with higher risks and requires constant market monitoring. Understanding your investment goals and risk tolerance is essential in choosing the right strategy.

Market Volatility

Tech stocks are often more volatile than stocks in other sectors. Rapid technological changes, competitive pressures, and market sentiment can lead to significant price fluctuations. Understanding the factors that contribute to market volatility can help you navigate these risks.

It’s crucial to be prepared for market downturns and have a strategy in place. This could involve setting stop-loss orders or having a diversified portfolio to cushion against sudden market drops. Regularly reviewing and adjusting your investment strategy can help you manage volatility effectively.

Stock Selection Methodology

Choosing the right tech stocks requires a systematic approach.

Expert Opinions and Analysis

Consulting expert opinions and analysis can provide valuable insights into stock selection. Financial analysts and market experts often publish reports and recommendations based on their research. These can help you identify promising tech stocks and make informed decisions.

It’s beneficial to follow multiple analysts to get a well-rounded view. Comparing different expert opinions can highlight common trends and divergent views, providing a more comprehensive understanding. Additionally, subscribing to financial newsletters and joining investment forums can keep you updated with expert insights.

Dividend Yield

Dividend yield is an important factor for investors seeking regular income from their investments. Some tech companies distribute a portion of their profits as dividends to shareholders. Assessing the dividend yield can help you identify tech stocks that offer both growth potential and income generation.

Companies with a history of consistent dividend payments are often more financially stable. However, high dividend yields can sometimes be a red flag, indicating potential financial distress. It’s essential to analyze the sustainability of dividend payments by reviewing the company’s payout ratio and financial health.

Company Leadership and Management

The quality of a company’s leadership can significantly impact its success. Strong, visionary leaders can drive innovation and strategic growth. Evaluating the track record of a company’s executives and board members can provide insights into its future prospects.

Leadership stability and expertise in the tech industry are crucial factors to consider. Companies with experienced management teams are often better positioned to navigate challenges and capitalize on opportunities. Regularly following leadership changes and management strategies can help you assess the company’s direction.

Emerging Technologies and Their Impact

Emerging technologies are reshaping the tech sector and creating new investment opportunities.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming industries ranging from healthcare to finance. Companies that are at the forefront of AI and ML development are likely to experience significant growth. Investing in these companies can offer substantial returns over time.

AI and ML are driving efficiency and innovation across various sectors. Companies leveraging these technologies for product development, customer service, and data analysis are gaining competitive advantages. Staying updated with advancements in AI and ML can help you identify high-growth investment opportunities.

Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies have gained immense popularity in recent years. While they are still relatively new and volatile, they present unique investment opportunities. Companies involved in blockchain development or cryptocurrency trading can offer high growth potential.

Blockchain’s potential extends beyond cryptocurrencies, impacting sectors like supply chain management, healthcare, and finance. Investing in companies that are exploring blockchain applications can offer diversified growth opportunities. It’s important to stay informed about regulatory developments and market trends in the cryptocurrency space.

5G and Connectivity

The rollout of 5G technology is set to revolutionize connectivity and enable new applications such as the Internet of Things (IoT) and autonomous vehicles. Investing in companies that are leading the 5G charge can be a smart move for long-term growth.

5G technology promises faster speeds, lower latency, and enhanced connectivity, driving innovation across various sectors. Companies involved in 5G infrastructure, device manufacturing, and application development are well-positioned for growth. Understanding the 5G ecosystem and its potential impact can guide your investment decisions.

Quantum Computing

Quantum computing is an emerging field with the potential to solve complex problems beyond the capabilities of classical computers. Companies investing in quantum computing research and development are at the forefront of this technological revolution.

Quantum computing can impact industries such as cryptography, material science, and drug discovery. Investing in companies pioneering quantum technologies can offer long-term growth opportunities. Keeping track of advancements and breakthroughs in this field can help you identify promising investment prospects.

Augmented and Virtual Reality

Augmented reality (AR) and virtual reality (VR) are transforming user experiences in gaming, education, and retail. Companies developing AR and VR technologies are creating new markets and enhancing existing ones.

Investing in AR and VR companies can provide exposure to innovative technologies with broad applications. Understanding market trends and consumer adoption rates can help you identify high-potential stocks in this space. Regularly following industry news and product launches can keep you informed about developments in AR and VR.

Financial Performance and Stock Profiles

Analyzing financial performance and stock profiles is essential for making informed investment decisions.

Revenue Growth and Profit Margins

Revenue growth and profit margins are key indicators of a company’s financial health. Companies with consistent revenue growth and healthy profit margins are more likely to deliver strong returns. Look for tech stocks that demonstrate a solid track record in these areas.

It’s also important to consider the sources of revenue growth. Companies with diverse revenue streams and strong market positions are often more resilient. Analyzing quarterly earnings reports and financial statements can provide insights into a company’s growth trajectory and profitability.

Debt Levels and Cash Flow

High debt levels can be a red flag for investors. Companies with manageable debt levels and strong cash flow are better positioned to invest in growth opportunities and weather economic downturns. Analyzing these metrics can help you identify financially stable tech stocks.

Cash flow analysis provides insights into a company’s ability to generate cash from its operations. Positive cash flow indicates financial health and the capacity to fund growth initiatives. Reviewing debt-to-equity ratios and cash flow statements can help you assess a company’s financial stability.

by Allison Saeng (https://unsplash.com/@allisonsaeng)

Market Capitalization and Growth Potential

Market capitalization reflects the total market value of a company’s outstanding shares. Understanding a company’s market cap can help you evaluate its size, growth potential, and risk profile.

Large-cap tech companies often provide stability and steady growth, while small-cap companies offer higher growth potential but come with increased risk. Investing in a mix of large-cap and small-cap tech stocks can balance your portfolio. Regularly reviewing market capitalization and growth prospects can guide your investment strategy.

Visuals and Data Representation

Visuals and data representation can enhance your understanding of tech stocks and market trends.

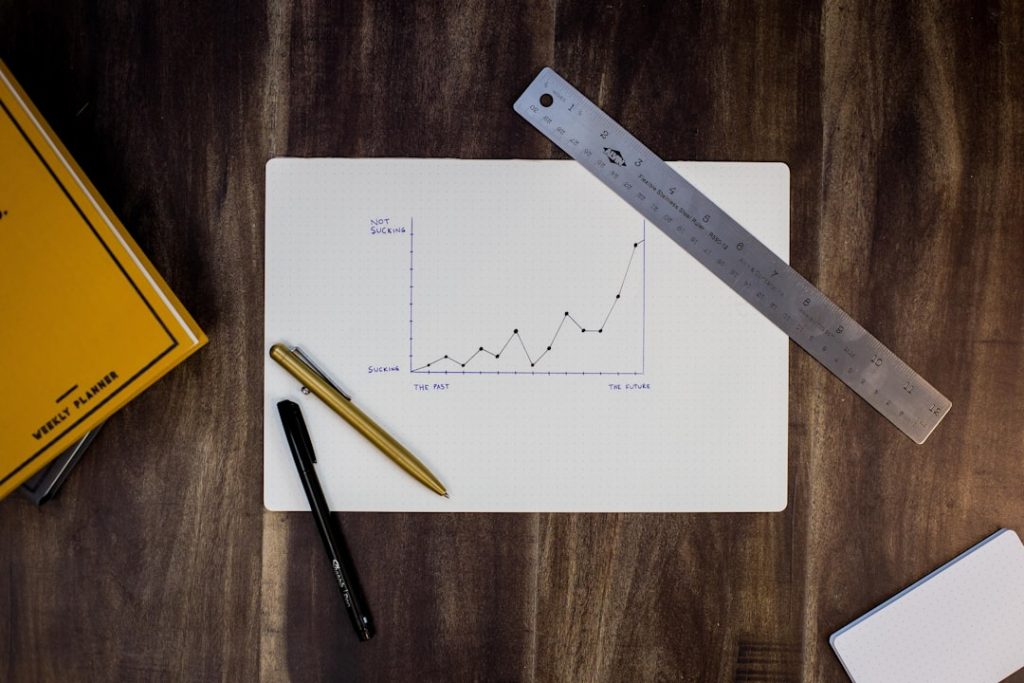

Charts and Graphs

Charts and graphs can provide a clear and concise representation of a company’s financial performance, market trends, and other key metrics. Utilize these tools to gain insights into stock performance and make data-driven decisions.

Line charts, bar graphs, and pie charts can help visualize trends and comparisons. Interactive charts available on financial platforms can provide real-time data and customizable views. Incorporating these visual tools into your analysis can improve your decision-making process.

Infographics

Infographics can simplify complex information and make it more accessible. They are particularly useful for understanding industry trends, comparing stock performance, and visualizing key data points.

Infographics can present data in a visually appealing format, making it easier to grasp essential information quickly. Using infographics to summarize research findings, financial metrics, and market trends can enhance your investment analysis. Sharing and discussing infographics with other investors can also provide new perspectives.

Interactive Dashboards

Interactive dashboards allow you to explore financial data dynamically. These tools enable you to customize views, filter data, and analyze key metrics in real-time.

Many financial platforms offer interactive dashboards that provide a comprehensive overview of stock performance, industry trends, and financial metrics. Utilizing these dashboards can enhance your ability to